Education is often called the key to opportunity,

but for many families around the world, financial

challenges make it difficult to keep their children

in school. Tuition fees, uniforms, books, and transportation costs can add up quickly. In households where resources are scarce, parents sometimes face the painful choice of pulling their children out of school so they can contribute to the family income. This is where microloans play an important role. These small but impactful financial tools can help families bridge gaps, invest in their children’s future, and ultimately break cycles of poverty through education.

Microloans are small loans provided to individuals who may not qualify for traditional banking services. They are often extended by microfinance institutions, community organizations, or local cooperatives. The amounts are usually modest, but they are designed to meet specific needs. A loan might help a mother purchase materials to start a small shop, or assist a farmer in buying seeds for the planting season. With the income generated from such ventures, families are better able to cover school-related expenses for their children. This connection between financial empowerment and educational access is one of the most encouraging outcomes of microfinance.

One of the most immediate ways microloans help education is by easing the burden of school fees. In many countries, even public education comes with costs that low-income families struggle to meet. Parents may have to pay registration fees, examination fees, or buy necessary supplies. A small loan allows them to handle these expenses without sacrificing meals or other essentials. By smoothing out financial challenges, microloans keep children in the classroom, where they can focus on learning rather than worrying about whether they will be able to continue their studies.

Another significant contribution of microloans is the way they support parents in building stable sources of income. A family that has a steady livelihood is less likely to pull children out of school during difficult times. For example, when a parent uses a microloan to invest in a small business, such as selling handmade goods or running a food stall, the profits can cover recurring educational costs. This ongoing support ensures that schooling is not interrupted year after year. Over time, such stability leads to higher rates of school completion and greater opportunities for children to pursue higher education or vocational training.

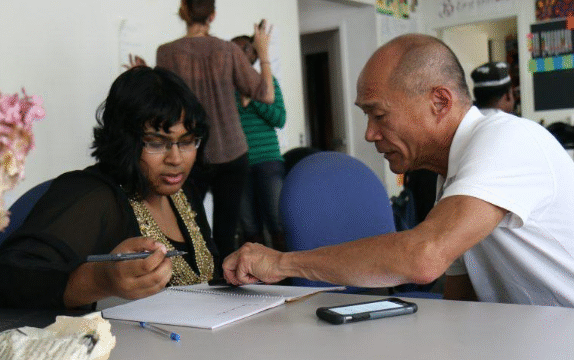

Microloans also empower women, who are often the primary caregivers and decision-makers in families regarding children’s education. Many microfinance programs specifically target women because research shows they are more likely to invest their earnings in health, nutrition, and schooling. When a mother receives a loan, she often channels the benefits directly toward her family’s well-being. This focus on education has a ripple effect, as educated children grow up with better opportunities and are more likely to prioritize learning for their own future families. In this way, microloans do not just support one generation, but create positive cycles that last for many years.

Beyond covering fees and basic supplies, microloans can help families provide a better overall learning environment for children. A loan might help a family improve their home, giving children a quiet and safe space to study. It might allow them to purchase a bicycle so that children can travel to school more easily, saving time and energy. In rural areas, it could mean having enough income to afford adequate meals, ensuring that children go to school nourished and ready to concentrate. Each of these improvements contributes to educational success and highlights how financial tools can have a direct impact on learning outcomes.

Microloans also foster a sense of dignity and independence among parents. Instead of relying solely on external aid, families who access microloans are able to take charge of their financial decisions. This empowerment strengthens their confidence and motivates them to plan for the future. Parents who see the tangible results of their hard work are more likely to stay committed to investing in their children’s education. This sense of ownership often extends to the children themselves, who witness the sacrifices their parents make and are encouraged to value education even more.

The impact of microloans on education can also be observed at the community level. When multiple families in a village or neighborhood use microloans to keep children in school, the collective effect is substantial. Schools may see higher attendance, leading to stronger academic performance and more motivated teachers. Over time, as more children graduate and pursue careers, entire communities can benefit from higher literacy rates and improved economic opportunities. Microfinance, therefore, not only transforms individual households but also contributes to broader social development.

Of course, microloans are not a perfect solution. Families still face challenges such as high interest rates in some regions, limited availability of microfinance programs, or unexpected economic hardships. However, when managed responsibly and paired with supportive services like financial education, microloans can be highly effective. They are best viewed as one tool among many that help families improve their quality of life and give their children the chance to learn.

Success stories from around the world illustrate the power of microloans in promoting education. In some regions of South Asia, mothers have used microloans to purchase sewing machines, creating small tailoring businesses that fund school uniforms and textbooks. In parts of Africa, microloans have enabled farmers to diversify their crops, ensuring stable income that supports school fees throughout the year. In Latin America, families have opened small food stands or craft shops with the help of microloans, giving their children opportunities to complete primary and secondary education. Each of these stories demonstrates that small financial investments can yield life-changing results when directed toward education.

Looking ahead, expanding access to microloans can play an important role in achieving global education goals. Governments, non-profit organizations, and private lenders can work together to make these resources more widely available, particularly in underserved rural areas. Partnerships that combine microloans with scholarships, mentorship programs, or community learning initiatives can strengthen the impact even further. By continuing to innovate and expand microfinance opportunities, societies can help ensure that no child is left behind due to financial barriers.

Education opens doors, but families need the means to walk through them. Microloans provide that stepping stone by giving parents the financial flexibility to support their children’s studies. Whether through paying fees, buying supplies, or building sustainable livelihoods, these small loans create pathways to brighter futures. When families are given the chance to invest in education, the benefits extend far beyond the classroom. Generations are lifted, communities grow stronger, and the promise of opportunity becomes a reality for more children around the world.